Protocol Update: stVol Hybrid live on Blast Sepolia Testnet

The 100x maker just got faster and more stable

*Updated June 6

As of June 4 00:00 UTC, stVol has updated its ‘1 hour’ product contract. This version introduces major enhancements in user experience through a ‘hybrid’ approach.

Highlights:

No more manual claims required

No wallet confirmation for every trade

Lower order latency

Less network errors

New option charts available

In addition to this change, the team has decided to sunset the ‘1 day’ product.

Why bother the change?

stVol was already great the way it was before, but it had some issues underneath. Initially, stVol aimed to make the options trading process fully on-chain. However, this approach encountered several technical challenges.

Thankfully, two trading competitions were enough for us to realize that this wasn’t good enough in the long run.

First of all, trading was inconvenient. Users had to make in-wallet confirmations for every order, which isn’t an ideal flow when you are tackling volatile markets for that 100x. And after each round was over, users had to claim their winnings manually. This process is also an unnecessary step in trading, and we wanted to rid of it as soon as possible.

Second, it was too slow - for both users and stVol. Even after multiple clicks in your wallet, submission and settlement latency were too long. Each order took over 5 seconds in the previous smart contracts, which is critical for ultra-short-term options trading.

Third, the process was cost-inefficient. Every order, regardless of execution, incurred gas fees. While the fee was very small, it could still act as a barrier to trading freely.

Finally, order submissions were unstable - bottleneck issues occurred in high-traffic environments. We often received complaints from users experiencing transaction errors.

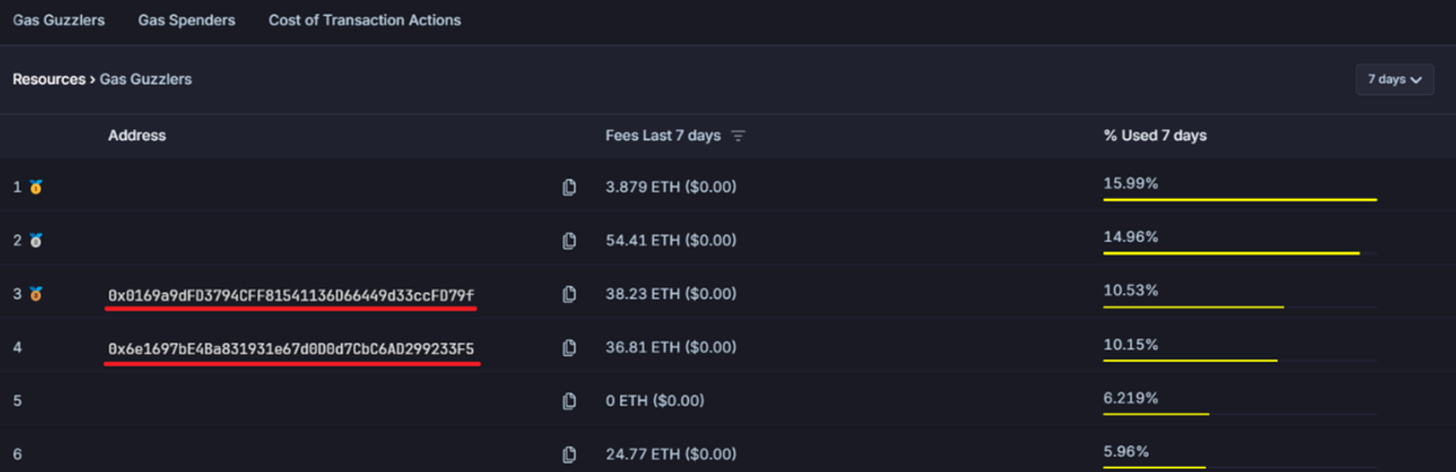

All these problems are partly because we are testing so rigorously on the Blast Testnet. Our smart contracts were constantly on the top of the Gas Guzzler leaderboards (not accessible anymore).

Our new approach

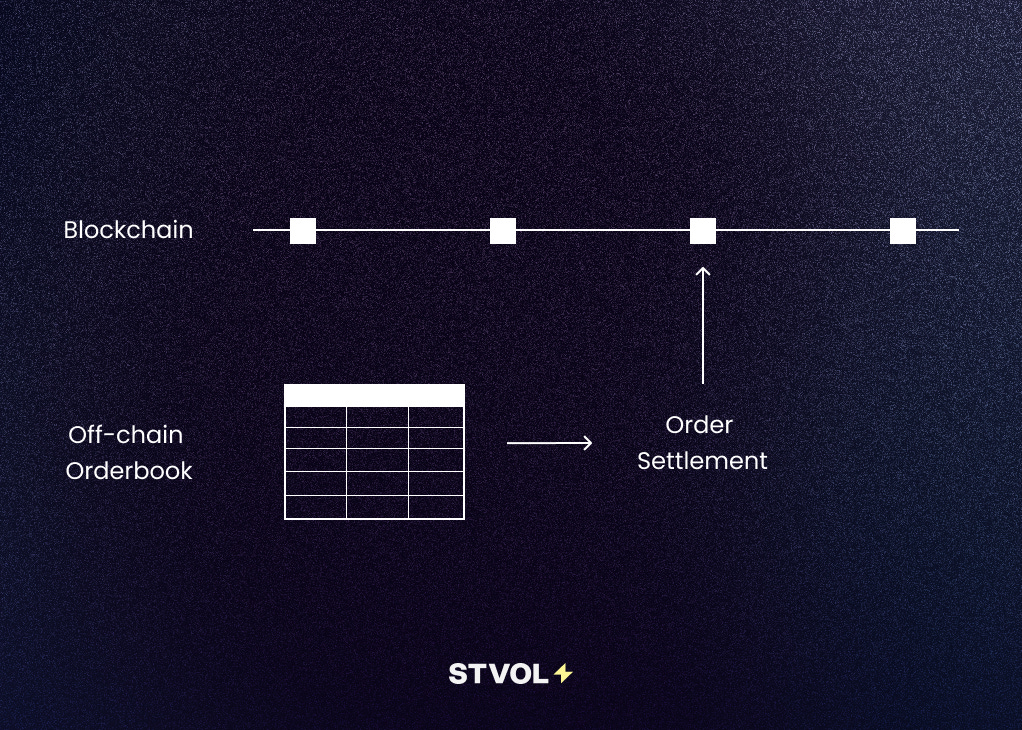

stVol’s new smart contract employs a hybrid approach with on-chain settlement and off-chain orderbook management.

It’s similar to methods used by other major perpetual DEXs like dYdX to optimize user experience in terms of trade execution, orderbook management, and costs.

What happens under the hood: limit orders for each product is listed in an off-chain orderbook. When an order is filled (either by a market order or a price taker), this is immediately recorded on-chain.

Every balance-affecting action is still publicly stored on the decentralized blockchain.

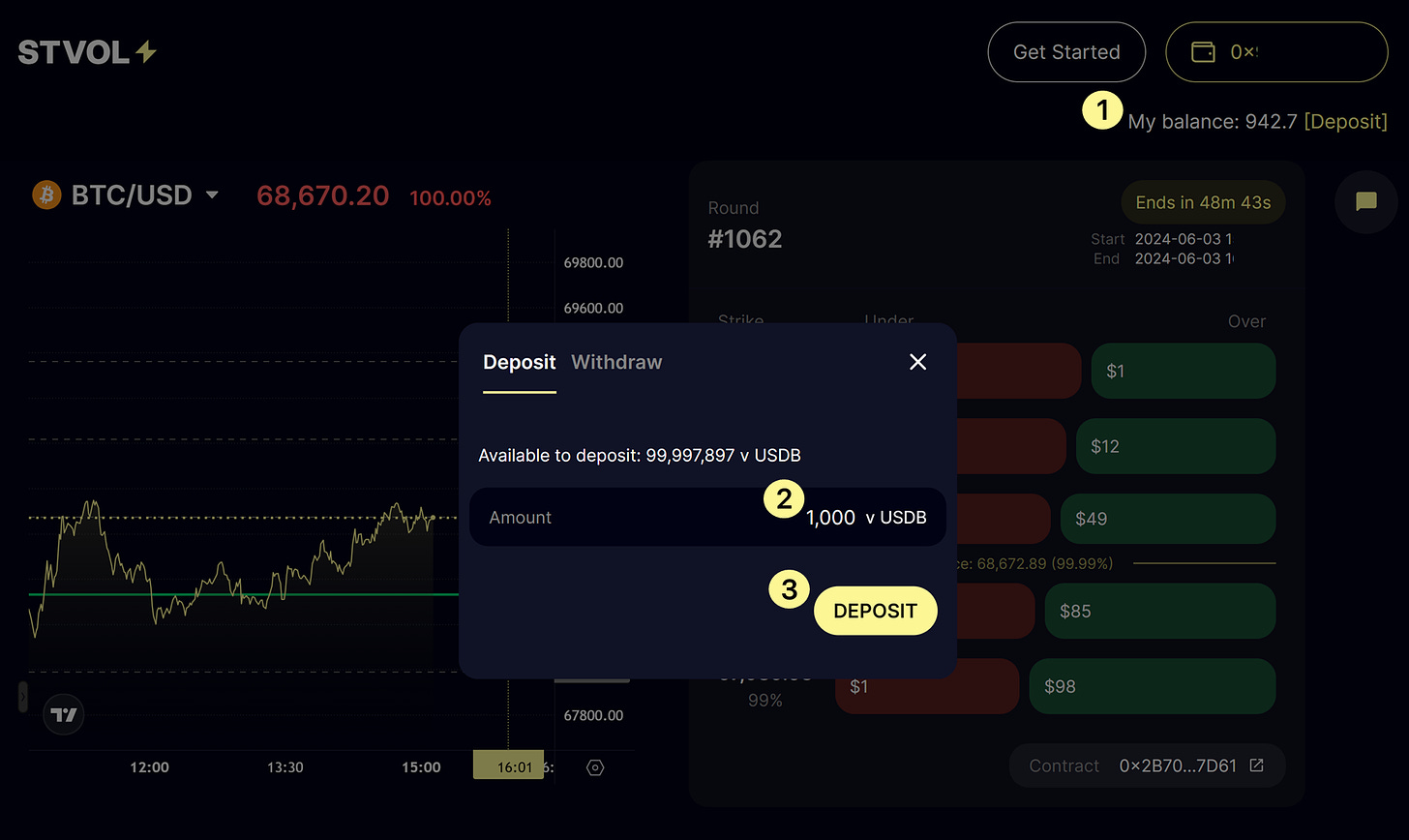

In this hybrid system, stVol introduces the concepts of Deposit and Withdraw. Users can approve & deposit the amount they wish to trade in stVol’s on-chain contract.

When a user decides to stop trading on stVol, they can withdraw at any time without any fees or lockups. Both Deposit and Withdraw are on-chain actions, each requiring a wallet signature.

What’s new

Enhanced trading experience: trades are now submitted instantly, with no transaction fees required anymore. No more claims after each round as well.

Balance

Instead, you’ll have to deposit some tokens to start trading on stVol.

Option Information

We’ve added new features so you can get a better understanding of trading on stVol. Available in the Order pop-up.

Orderbook: Displays the current open orders for this round.

Price Trend: Movement of Over (Green Line) / Under (Red Line) option price.

Historical Trades: List of orders placed during this round.

Make a Trade

Once you’ve made a deposit, trading itself has just become simpler.

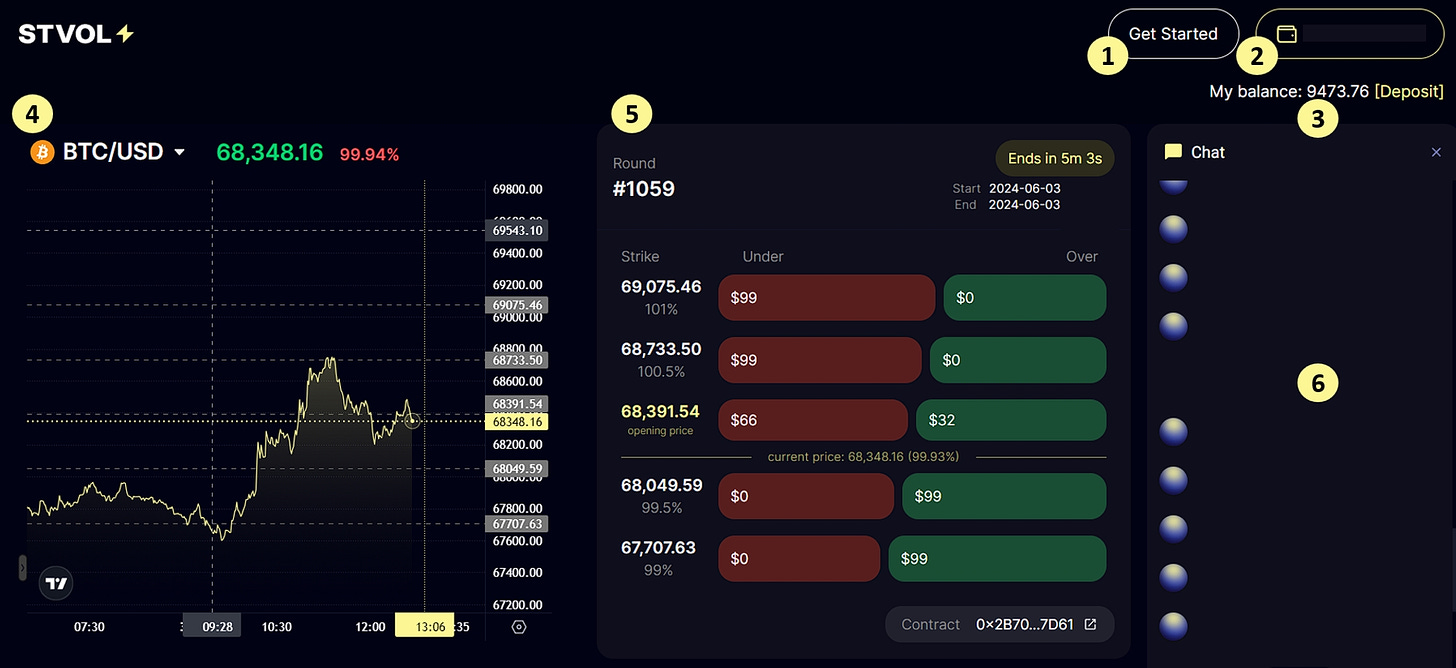

Trade Page Interface

Get Started: For first-time visitors: Learn how to get started

Connect Wallet: Metamask & Coinbase supported, as of now

My Balance: Your stVol balance. Learn about deposits

Underlying Chart: Price chart for underlying assets (BTC / ETH).

Your orders will be highlighted here (Over: Green / Under: Red / White: Both)

Dotted lines represent currently available strikes.

Highlighted time shows when the current round expires.

Round: Information on this round - including remaining time to expiry, strike prices, contract address, and the market prices for Under / Over options.

Hover on price bar to compare strike with the current price

Click on price bar to view submit order and view informative charts

Chat: Interact with fellow stVol users :)

Order

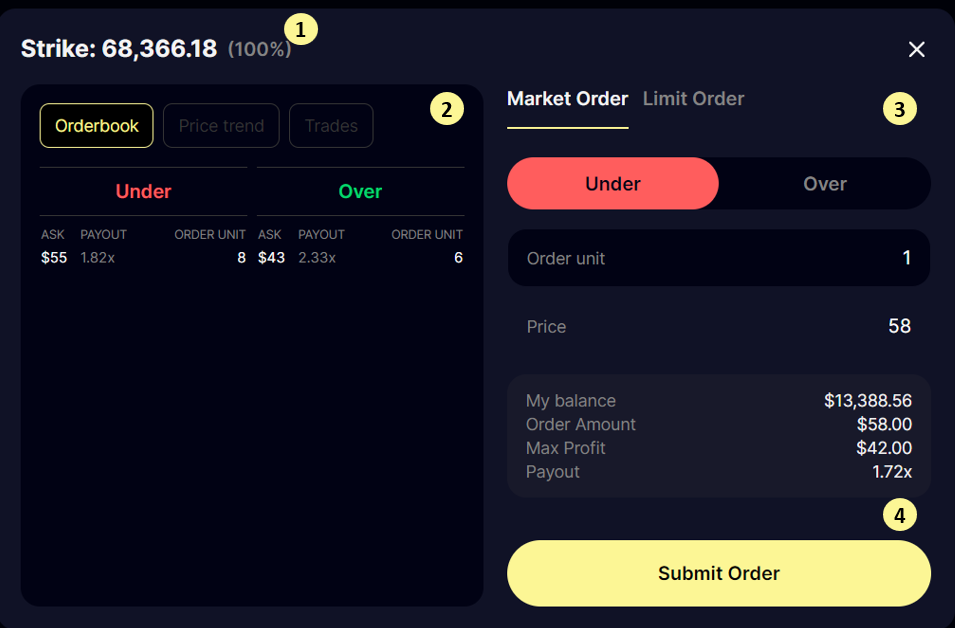

You can simply submit an order in either Under or Over by clicking the red / green bars in the Round -> checking the price -> inputting and submitting the order units (& price, in case of Limit Order).

Strike: Shows the strike price of the chosen option.

Option Info:

Orderbook: Displays the current open orders for this round.

Price Trend: Movement of Over (Green Line) / Under (Red Line) option price.

Historical Trades: List of orders placed during this round.

Order Area

Market Order / Limit Order: Market Orders are automatically filled at the best price.

Under / Over

Order Unit: Each unit is worth $100 if your position wins

Order Information:

Balance

Order Amount

Max Payout

Payout ( Order Unit * 100 / Order Amount)

Submit Order

Manage Position

My Position

Filled / Open

Filled: Market Orders and filled Limit Orders. These orders are NOT cancellable.

Open: Limit Orders that remain within the order book. These orders are cancellable and will be refunded at round end if not filled.

ID: Unique ID of your trade.

PnL: Current PnL, subject to change at expiry.

Time: Timestamp of your order.

History: Your trade history, organized by rounds. Click on each round number for detailed trade info.

Start / End: Fixing prices and timestamps for each round.

Placed / Result: Amount you ordered & earned for each round.

Another change - we’re sunsetting the ‘1 day’ product, to focus on ‘1 hour’ first.

We hope you enjoy this new change, and please feel free to reach out with any feedback!

stVol: Options redefined for retail. Infinite ∞ leverage. Lightning-fast results.

⚡Pay $ (from 1 to 99) to win 100

⚡Expires every hour

⚡Stablecoin in / Stablecoin out

Twitter (Official) | Twitter (Ninja) | Website | Discord